In these times, double down — on your skills, on your knowledge, on you. Join us Aug. 8-10 at Inman Connect Las Vegas to lean into the shift and learn from the best. Get your ticket now for the best price.

The board of directors of the National Association of Realtors voted overwhelmingly Thursday morning to approve a proposal tying its annual membership dues to a measure of inflation.

The policy increases the likelihood of annual dues hikes, particularly since it does not include a previously-suggested cap on increases.

The board separately voted to increase annual dues for its 1.5 million members in 2024 by 4 percent to $156. NAR’s annual dues currently stand at $150, plus a special assessment for its consumer ad campaign, which was raised to $45 last year.

The proposal to raise dues by $6 in 2024 was the only policy recommendation from NAR’s Finance Committee to generate any discussion at the board meeting, after one director from Austin, Texas, Socar Chatmon-Thomas, proposed that dues be raised even more in 2024, by $20, to $170.

Supporters of that amendment argued that the bigger increase could eliminate the need to come back for further annual increases in the future, but other directors spoke against the amendment in favor of addressing NAR’s expected budget deficit with the Finance Committee’s proposal to have dues rise with inflation. The amendment failed.

NAR Treasurer Greg Hrabcak presented the committee’s dues inflation proposal to the board on the final day of NAR’s midyear conference, the Realtors Legislative Meetings, at the Marriott Marquis in Washington D.C.

Greg Hrabcak

“The committee is charged with providing prudent solutions that keep this association fiscally sound and your assets secure,” Hrabcak said.

“The committee always works to achieve this through a lens that keeps all of you, our member, first in their considerations.”

The committee’s proposed budget policies “reflect a fresh approach to our budgeting philosophy moving forward” and “achieves the right balance between these roles by ensuring that NAR’s reserve levels remain healthy and that your dues dollars are not eroded by inflationary pressures,” he added.

The approved policy states that, starting in 2025, NAR’s Finance Committee will use the comprehensive overall Consumer Price Index — a measure of inflation — “as a guide” each year when it recommends an annual dues amount to the board of directors.

“This would mean that the Finance Committee, when preparing each budget proposal, would analyze the CPI index to determine whether to recommend a dues increase to the Board of Directors,” the committee stated in its rationale for the proposal to the board.

While Hrabcak told conference attendees earlier in the week that dues increases would be capped at 4 percent, the actual policy text does not mention a 4 percent cap.

Asked why the final text of the policy does not include the cap, NAR spokesperson Mantill Williams told Inman, “[T]he committee simply came to the conclusion that it is important that the Finance Committee has the ability to pause or reduce any increase based on the index after assessing NAR’s overall financial health and current economic conditions.”

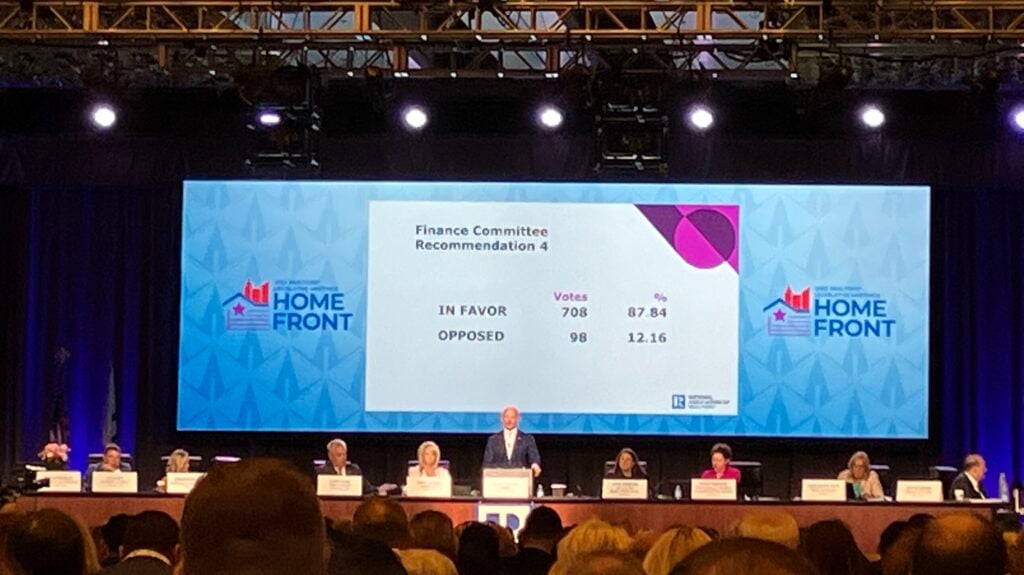

The board approved the dues inflation policy 708-98 without any discussion on the floor.

In an exhibit to the proposal provided to the directors, the committee noted that, in 2023, NAR’s operating budget anticipates net income of $8.4 million, but in 2024, the association expects a net loss of $14.2 million, even with the $6 increase in annual dues.

This is largely due to an expected decline in membership to 1.38 million in 2024 after ending 2022 at a record 1,580,971 members.

The committee also cited “cost increases of 30{ecd1c82889c5dde6baa4cae2f6d3d4c330bac74c2b880dafaca78809ece33a56} in some meetings and travel-based programs.”

The committee anticipates that NAR membership will bump up to 1.4 million members in 2025, 1.41 million members in 2026, and 1.42 million members in 2027 — and proposed that each of those years, dues rise 4 percent with CPI.

The committee anticipates that NAR’s non-dues revenue will rise to $54.1 million in 2024 from $51.5 million this year.

Bob Goldberg

“In preparing the 2024 proposal, staff, under CEO Bob Goldberg’s guidance, trimmed expenses wherever possible [and] challenged themselves to grow non-dues revenue,” the committee said.

“From the initial budget proposal to what is being presented, staff improved the bottom line by more than $2 million,” the committee added.

Other than tying dues to inflation, the Finance Committee said it also considered “wholesale slashing of programs and services,” which it deemed “not helpful to our members;” one large dues increase, which it deemed “less than helpful in this current economy;” or using operating reserves to fund annual deficits, which the committee said “will breach the board- mandated reserve requirements by 2027.”

“The passage of this new budgeting tool keeps NAR financially healthy and strong for the upcoming years and diminishes the negative impact of inflation on our expenses,” the committee said.

Even with the dues increase next year, the association will still dip into its reserves. NAR’s Finance Committee expects the trade group’s 2024 operations to cost $175 million and to bring in $168 million, which will require the trade group to use $6.9 million in operating reserves.

Next year is also an election year and the trade group expects its gross expenses for advocacy to come in at $115 million and gross revenues to be $101 million, requiring the use of advocacy reserves of $13.9 million.

Similarly, NAR expects its consumer advertising campaign to cost $67.9 million and bring in $62.2 million requiring the use of $5.7 million in campaign reserves.